Table of Contents

- How to Use – IFTA Reporting – My Fuel Tax

- 2025 Federal Tax Tables | Real Business Solution Blog

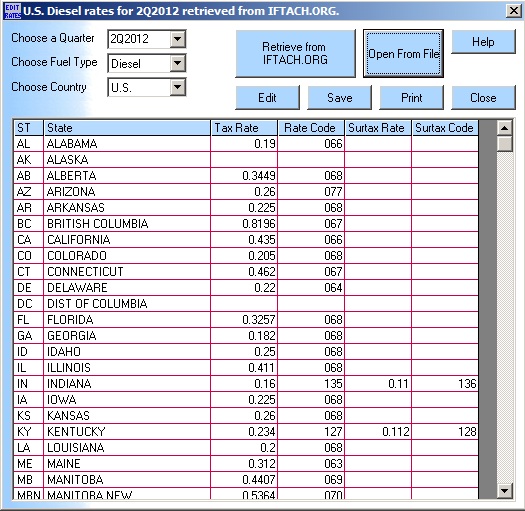

- Fillable Online Form IFTA-105 IFTA Final Fuel Use Tax Rate and Rate ...

- Form IFTA-105: (6/06): IFTA Final Fuel Use Tax Rate And Rate Code ...

- Printable Ifta Forms - Printable Forms Free Online

- Understanding IFTA and Fuel Taxes | Episode 29 | Haulin Assets

- Fillable Online Form IFTA-105 IFTA Final Fuel Use Tax Rate and Rate ...

- 2025 Tax Forms 2025 Sr Schedule 1 - Martin Riggs

- Fillable Online Form IFTA-105. IFTA 105 4th quarter table 1 Fax Email ...

- Ifta Quarterly Fuel Tax Report Due Dates 2025 - Simon Macdonald

What is the International Fuel Tax Agreement (IFTA)?

How Does IFTA Work in Texas?

Benefits of IFTA for Texas Businesses

IFTA offers several benefits for Texas businesses, including: Simplified Reporting: IFTA allows businesses to report fuel taxes for multiple jurisdictions through a single tax return, reducing administrative burdens and increasing efficiency. Increased Compliance: IFTA promotes compliance with fuel tax laws, reducing the risk of penalties and fines. Reduced Costs: By simplifying fuel tax reporting and collection, IFTA can help businesses reduce costs associated with fuel tax management.